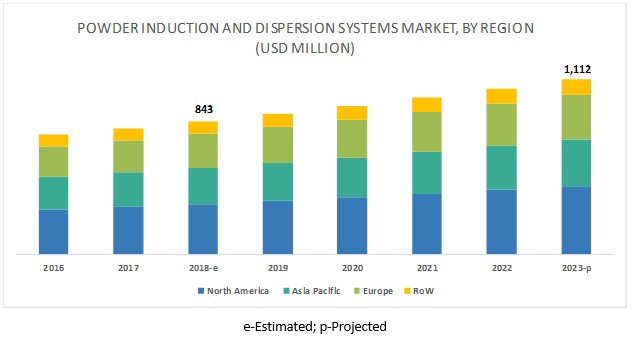

The overall powder induction and dispersion systems market is projected to grow from USD 843 million in 2018 to USD 1,112 million by 2023, at a CAGR of 5.7%. The use of powder induction and dispersion systems follows the increasing need for advanced mixing technologies and precision solutions. The demand for improving process safety and increasing production capacity is projected to increase the application of powder induction and dispersion systems in the pharmaceuticals industry.

On the basis of application, the pharmaceuticals segment is projected to be the largest contributor in the powder induction and dispersion systems market during the forecast period

The powder induction and dispersion systems market is segmented, on the basis of application, into food & beverages, pharmaceuticals, cosmetic and personal care products, and chemicals. The pharmaceuticals segment is projected to record the highest CAGR between 2018 and 2023. The pharmaceutical industry witnesses significant adoption of powder induction and dispersion systems due to their sanitary standards and precision mixing requirements in pharmaceutical companies.

Aftermarket solutions to drive the adoption of inline mixing systems

The powder induction and dispersion systems market is segmented, on the basis of mixing type, as inline and in-tank. The inline segment is projected to record a higher CAGR between 2018 and 2023. The availability of aftermarket solutions is a key factor driving the growth for these systems. The ability to customize and retrofit shear pumps for different tank designs benefits the end users, in terms of cost and production time for tanks.

Process flexibility offered by continuous systems leads the way for powder induction and dispersion systems

The powder induction and dispersion systems market is segmented on the basis of process into continuous and batch systems. The continuous systems provide continuous operation and processing of compounds and are projected to witness a higher CAGR between 2018 and 2023. The powder induction and dispersion systems market in a continuous form is used across chemical applications such as paints and water-based systems. The use of batch systems is projected to decrease over the forecast period given the process advantages offered by continuous systems.

North America is projected to account for the largest market size during the forecast period

The North American powder induction and dispersion systems market is estimated to account for the largest share during the forecast period, while the Asia Pacific market is projected to grow at the highest CAGR. The increasing production and exports of pharmaceutical and chemical products are aiding the growth of the powder induction and dispersion systems market in the region. North America increasingly witnesses a presence of manufacturers in the powder induction and dispersion systems market, with major industry leaders maintaining their operations in the region.

Key Market Players

Key players in the market include Admix Inc. (US), John Bean Technologies Ltd. (US), SPX Flow (US), Ystral GmbH (Germany), IDEX Corporation (US), Charles Ross & Son Co. (US), Hayward Gordon Group (Canada), Axiflow Technologies Ltd. (US), Silverson Machines Inc. (UK), Noritake Co. Ltd (Japan), IKA Werke GmbH (Germany), and Joshua Greaves & Sons Ltd. (UK). These players are undertaking strategies such as new product launches, acquisitions, and expansions to improve their market position and extend their competitive advantage.

Recent Developments

- In July 2018, John Bean Technologies acquired FTNON (Netherlands), a technology services and equipment provider for the food & beverage industry. The acquisition was valued at USD 36 million and expands the company’s production in high-value fruit and vegetable processing. The acquisition also gives JBT access to FTNON’s robotics division, which would be operated through the company’s automated systems division.

- In September 2018, Charles Ross & Son launched a new multi-shaft mixer. The new 150-gallon triple shaft mixer is designed to be powerful and efficient. The system comprises of pneumatic clamps and is also installed with the latest safety features to protect workers during the operation.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry applications for powder induction and dispersion systems?

- What is the impact of the pharmaceutical industry on powder induction and dispersion systems?

- What are the new technologies being introduced in powder induction and dispersion systems?

- What are the latest trends in the powder induction and dispersion systems market?