The yeast market was valued at USD 3.23 Billion in 2016 and is projected to reach USD 5.40 Billion by 2022, at a CAGR of 9.0% from 2017 to 2022. The yeast market has been segmented on the basis of type, form, application, and region, whereas, the specialty yeast market has been segmented on the basis of type and region.

The years considered for the study are as follows:

- Base year – 2016

- Estimated year –2017

- Projected year – 2022

- Forecast period – 2017 to 2022

The objectives of the study include:

- To define, segment, and project the global market size for yeast

- To understand the structure of the yeast market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets with respect to the individual growth trends, prospects, and their contribution to the total market

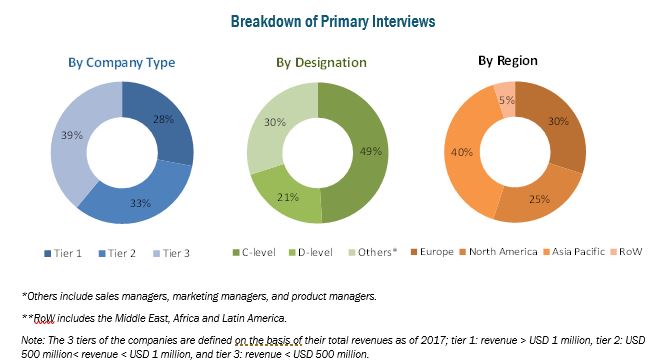

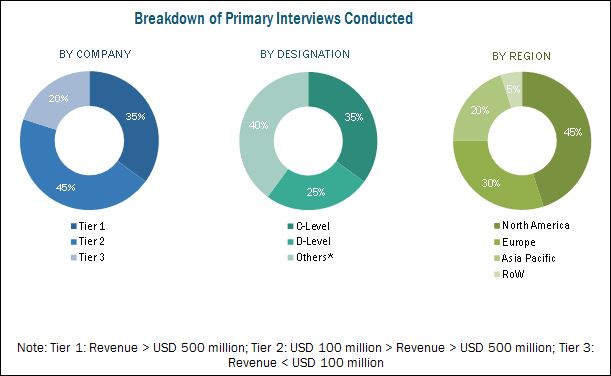

Research Methodology

This report includes an estimation of the market size in terms of value (USD million). Both, top-down and bottom-up approaches have been used to estimate and validate the size of the yeast market and various other dependent submarkets in the overall market. Key players in the market have been identified through secondary research such as Hoovers, Forbes, and Bloomberg Businessweek, company websites, annual reports, and their market share in respective regions has been determined through primary and secondary research. All percentage shares, splits, and breakdowns have been determined using secondary sources and were verified through primary sources.