The global liquid feed supplements market is estimated to be valued at USD 4.23 Billion in 2015. The market is projected to grow at a CAGR of 5.5% from 2015 to 2020 and reach USD 5.53 Billion by 2020. The liquid feed supplements market is segmented on the basis of its type, source, and livestock. It is further segmented on the basis of regions, such as North America, Europe, Asia-Pacific, Latin America, and the Rest of the World (RoW). With the increasing demand of livestock products, the liquid feed supplements market is expected to grow in future years. The years considered for the study are as follows:

- Base Year – 2014

- Estimated Year – 2015

- Projected Year – 2020

- Forecast Period – 2015 to 2020

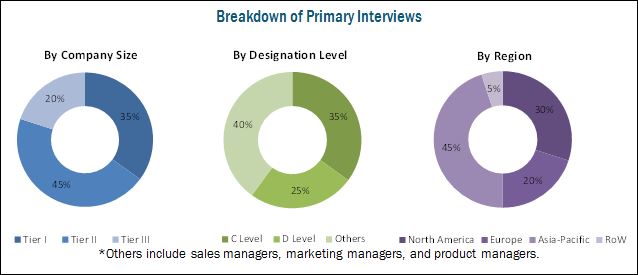

This report includes the estimation of market sizes for value (USD million) and volume (KT). Top-down and bottom-up approaches have been used to estimate and validate the size of the liquid feed supplements market and to estimate the size of various other dependent submarkets. Key players in the market have been identified through secondary research, and their market share has been determined through primary and secondary research. All percentage shares, splits, and breakdowns have been determined using secondary sources and were verified through primary sources.

Market Ecosystem:

The upstream players such as the raw material suppliers of the liquid feed supplements and the downstream stakeholders such as the manufacturers and end-user industries of the liquid feed supplements influence the global liquid feed supplements market.

Target Audience

The report is targeted toward the existing players in the industry, which include feed manufacturers and research institutions. Key participants in the supply chain of the liquid feed supplements are raw material suppliers, government bodies, distributors, and end users.

Manufacturing companies who offer the liquid feed supplements to other end users have been included in this report. For instance, Archer Daniels Midland Company (U.S.) Cargill, Incorporated (U.S.), GrainCorp Ltd. (Austria), Land O’ Lakes (U.S.), and BASF SE (Germany) are the top five major manufacturing companies profiled in this report.

Scope of the Report

On the basis of Type, the market is segmented as follows:

- Protein

- Minerals

- Vitamins

- Others (acids, enzymes, and fats)

On the basis of Source, the market is segmented as follows:

- Molasses (prills and granules)

- Corn

- Urea

- Others (soy and wheat bran)