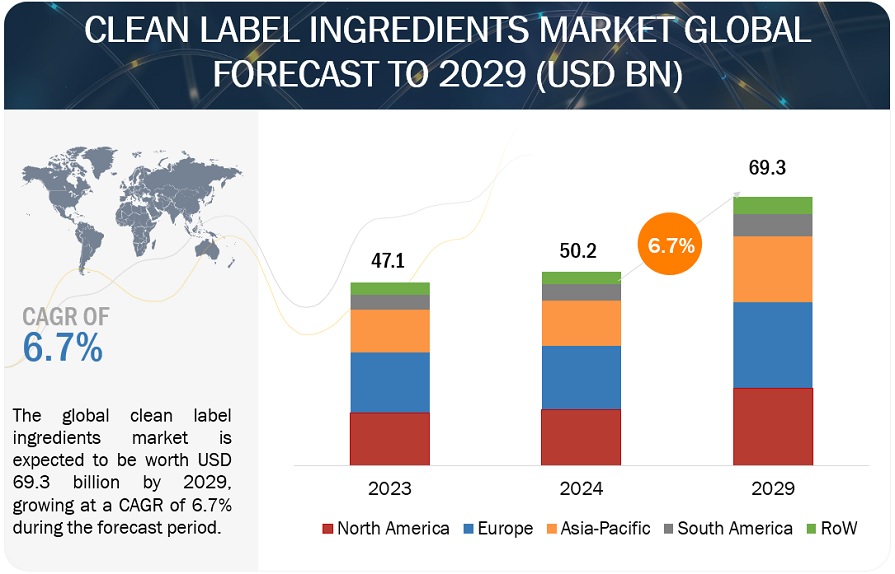

The clean label ingredients market is estimated to reach USD 47.10 Billion by 2022, growing at a CAGR of 6.6% from 2016 to 2022. The rise in clean label product launches that is fueled by an increase in the consumer demand for clean label food products to drive consumption of clean label ingredients and health issues associated with artificial food additives and food safety incidents are the factors driving this market.

‘Clean label’ ingredients are defined as food additives and ingredients such as colors, flavors, fruit & vegetable ingredients, starch & sweeteners, flours, malt, and others that comply with any or all of the primary factors, and at least one of the secondary factors. Primary factors include fewer product ingredients with no chemical name and easy to understand, no artificial additives or ingredients; secondary factors include natural, organic and non-GMO.

The years considered for the study are as follows:

- Base year – 2015

- Estimated year – 2016

- Projected year – 2022

- Forecast period – 2016 to 2022

The objectives of the report

- To define, segment, and forecast the size of the clean label ingredients market on the basis of type, form, application, brand, and region

- To project the market size, in terms of value, for each of the segments

- To forecast the size of the global clean label ingredients market and its various sub-markets with respect to four main regions, namely, North America, Asia-Pacific, Europe, and Rest of the World (RoW)

- To provide detailed information about crucial factors that are influencing the growth of the market (drivers, restraints, opportunities, industry-specific challenges)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market share and core competencies

- To analyze competitive developments such as new product launches, expansions, mergers & acquisitions, and agreements & collaborations in the clean label ingredients market

Research Methodology:

- Major regions were identified, along with countries contributing the maximum share

- Secondary research was conducted to find the value of clean label ingredients for regions such as North America, Europe, Asia-Pacific, and RoW

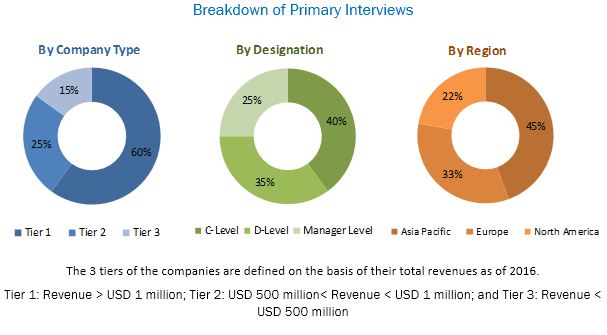

- The key players have been identified through secondary sources such as the Food & Drug Administration (FDA), the United States Department of Agriculture (USDA), and the Canadian Food Inspection Agency (CFIA) while their market shares in respective regions have been determined through both, primary and secondary research. The research methodology includes the study of annual and financial reports of top market players, as well as interviews with industry experts (such as CEOs, VPs, directors, and marketing executives) for key insights (both quantitative and qualitative) for the clean label market.

To know about the assumptions considered for the study, download the pdf brochure

The various contributors involved in the value chain of this market include clean label manufacturers such as Cargill (U.S.), Archer Daniels Midland Company (U.S.), Ingredion Incorporated (U.S.), and Tate & Lyle PLC (U.K.); government bodies & regulatory associations such as the USDA (United States Department of Agriculture), the FDA (Food and Drug Administration), and the EFSA (European Food Safety Authority); and end users such as various food & beverage manufacturers

Target Audience

The stakeholders for the report are as follows:

- Raw material suppliers

- Traders, distributors, and manufacturers & suppliers of clean label ingredients

- Food processors & food manufacturers

- Government and research organizations

- Trade associations and industry bodies

- Regulatory bodies such as Food and Drugs Organization (FDA), European Commission, European Food Safety Authority (EFSA), and Food Standards Australia New Zealand

Scope of the Report:

This research report categorizes the clean label market based on application, form, type, and region.

Based on Application, the market has been segmented as follows:

- Beverages

- Bakery

- Dairy & frozen desserts

- Prepared food/ready meals & processed foods

- Cereals & snacks

- Others (confectionery and condiment/culinary products (sauces, dressings, dips, and spreads))