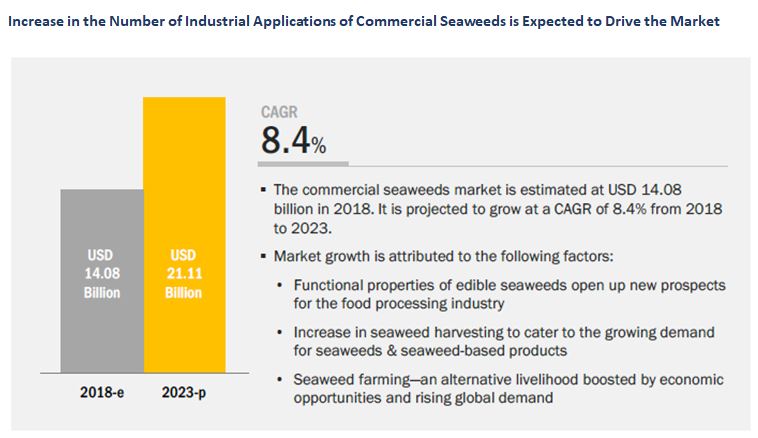

The feed preservatives market is projected to reach USD 3.57 Billion by 2022, at a CAGR of 9.2% from 2016 to 2022 due to the increasing demand for quality feed. This growth is largely fueled by the increasing meat consumption and rising concerns regarding its quality and safety.

The objectives of the study are as follows:

- To define, segment, and measure the feed preservatives market size and growth trends with respect to the type, livestock, feed type, and region

- To provide detailed information about the crucial factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To identify and analyze the effect/impact of changes in regulations/legislations and safety aspects on the feed preservatives market

- To analyze opportunities in the market for stakeholders and provide a detailed insight about the competitive landscape for key market leaders

The years considered for the study are as follows:

- Base year – 2015

- Estimated year – 2016

- Projected year – 2022

- Forecast period – 2016 to 2022

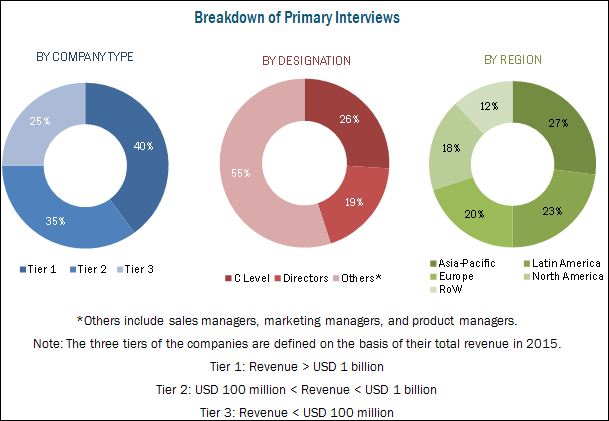

The research methodology used to estimate and forecast the feed preservatives market starts with capturing data on key players and their revenues through secondary sources such as annual reports, Factiva, and Bloomberg. The overall market size of feed preservatives was arrived at using the bottom-up procedure from its usage in different types of livestock feed which was validated through primary interviews and secondary research. Following this, a top-down procedure was employed to estimate the sizes of other subsegments based on ingredients and type of feed from the total market, which were then verified through primary research by conducting extensive interviews with key people such as CEOs, VPs, directors, and executives. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments.

The feed preservatives ecosystem comprises feed premix and additive manufacturers such as Kemin Industries, Inc. (U.S.), Nutreco N.V. (Netherlands), Impextraco NV (Belgium), and Biomin Holding GmbH (Austria) among others; specialty chemical manufacturers such as Perstorp Holding AB (Sweden) among others; animal nutrition & health companies such as Novus International, Inc. (U.S.), Merck Animal Health (U.S.), Alltech, Inc. (U.S.), BASF Animal Nutrition (Germany), and Dupont Nutrition & Health (U.S.) among others; and feed manufacturers such as Cargill, Incorporated (U.S.) and ADM Co. (U.S.) among others.

Target Audience

The report is targeted toward the existing players in the industry, which include:

- Feed & feed ingredient manufacturers and feed integrators

- Biotechnological companies involved in the production of organic acids and antioxidants

- Livestock meat processors and feed traders & distributors

- Livestock farmer and feed associations (International Feed Industry Federation)

- Agricultural research organizations

- Government regulatory authorities and government agencies

“The study answers several questions for stakeholders, primarily which market segments to focus on in the next two to five years for prioritizing efforts and investments.”